When doing business on social media platforms like Facebook, using advertising is an important part of your marketing strategy. And to carry out effective advertising campaigns on Facebook, choosing the right credit card for spending becomes extremely important. Please see the article “best credit cards for ad spend” below by Optimalmk.

Credit cards run Facebook ads

Credit cards are becoming a popular tool used for running ads on the Facebook platform. Using credit cards to advertise on Facebook brings many benefits to businesses, from flexibility in spending to effectively tracking and managing advertising budgets.

One of the key benefits of using credit cards for Facebook advertising is flexibility in budget management. The credit card allows users to set a maximum monthly advertising spending threshold, helping them control advertising costs easily. In addition, using a credit card also brings convenience when paying online advertising costs, helping to save time and effort for businesses.

However, using credit cards also requires caution and careful management of financial information. Users need to ensure that they pay their debts in full each month to avoid late fees and interest rate increases. Additionally, the use of credit cards needs to be combined with a careful and effective advertising strategy to ensure that advertising budgets are used most effectively.

Best credit cards for ad spend

Choosing the right credit card for advertising spending can depend on a variety of factors, including personal needs, offers, flexibility and associated fees. Here are some credit cards that can be considered best for advertising spending:

- Credit cards with advertising incentives: Some banks offer credit cards with special incentives for online advertising spending. These offers can include cashback, reward points, or direct discounts on advertising campaigns.

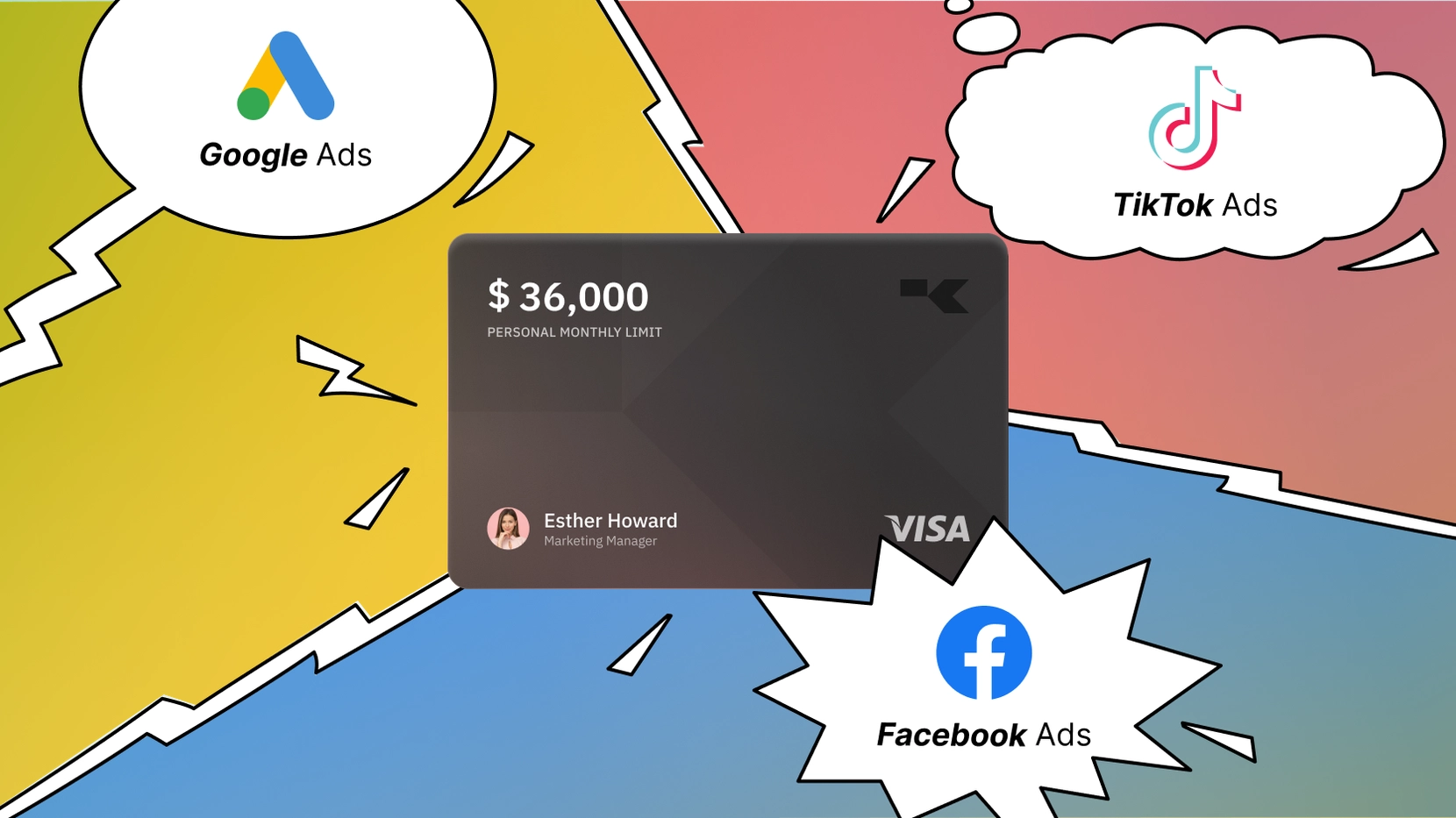

- Credit card with a high limit: Using a credit card with a high limit can help you manage your advertising budget more flexibly and facilitate large spending on advertising campaigns. important.

- Credit cards with flexibility: Highly flexible credit cards allow you to proactively change spending thresholds or convert debt to installments to adjust your advertising budget according to your business needs.

- Credit cards with reasonable fees: Choose a credit card with low or no fees to avoid unnecessary costs. Carefully calculate the fees associated with using the card to ensure that your advertising costs are not affected too much by these fees.

However, before deciding to use a particular credit card for advertising spending, you should research and compare each card’s offers, terms and conditions to ensure that it reflects exactly your needs and priorities.

Be careful when using credit cards

When using a credit card, there are some important notes that you need to consider to avoid risks and optimize benefits from using the card. Here are some things to remember when using credit cards:

- Manage your budget: Always keep a budget for credit card usage and don’t exceed your ability to pay. Set a reasonable spending threshold and stick to it.

- Pay on time: Always pay the full amount due to avoid penalty fees and interest charges. If possible, pay off your debt in full each month to avoid interest being charged on the remaining balance.

- Control spending: Track transactions and total debt on your credit cards to avoid uncontrolled spending and accumulating too much debt.

- Choose the right card: Choose a credit card that suits your needs, such as a card with promotional offers or a card with a low interest rate.

- Protect personal information: Protect your personal information and credit card spending by avoiding sharing card information or PIN numbers with others and double checking before using your card on websites unreliable.

- Check and compare transactions: Regularly check and compare transactions on card statements or on the bank’s mobile application to detect inappropriate transactions early.

- Take advantage of offers: Use the offers and rewards that come with your credit card like bonus points, cashback, or discounts to maximize the benefits of using the card.

Using credit cards can bring many benefits if managed intelligently and responsibly. It is important to consider and comply with the above notes to ensure effective and safe use of your credit card.

Above are some credit cards that are highly rated when used for advertising spending on Facebook. However, choosing the most suitable credit card still depends on the needs and financial situation of each individual or business. Please consider carefully and find out information before deciding on a credit card to ensure that your Facebook advertising will be performed effectively.

Contact Info

Information about “best credit cards for ad spend” hopes to provide you with additional necessary knowledge. At optimal FB, there is a team of highly qualified and experienced staff and experts who will provide fb agency ad account as well as support when you run Facebook ads. Contact us via phone number: +84 564 104 104.